Credit card purchases seem to happen within seconds. A customer swipes, taps, or dips their card (or smartphone), or submits their card information online, and almost immediately, the transaction is approved. It’s impossible to know from the outside, but there are many players who are behind-the-scenes that make everything possible.

Who’s Involved in a Credit Card Transaction?

- Cardholder/Consumer: Initiates the credit card transaction by making a purchase in a store, online, or over the phone.

- Merchant: Sells a product or service to a customer and provides the option and technology to pay with a credit card.

- Acquiring Bank/Merchant’s Bank: Sends authorization requests to the card network and provides the merchant with a response. They also allow the merchant to open a merchant account for receiving funds.

- Payment Processor: A technology company who authorizes transactions through specific channels on behalf of the acquiring bank.

- Card Network/Card Association: A company who provides infrastructure to facilitate credit card transactions between the merchant and the card issuer. Card networks—Visa, Mastercard, Discover, and American Express—charge an interchange fee for processing credit card transactions.

- Issuing Bank/Card Issuer: The bank who provides the consumer’s credit card. The card issuer approves or denies transactions based on the cardholder’s account status and available credit.

Step 1: Authorization

Credit card authorization lets the merchant know whether the credit card is approved for the purchase.

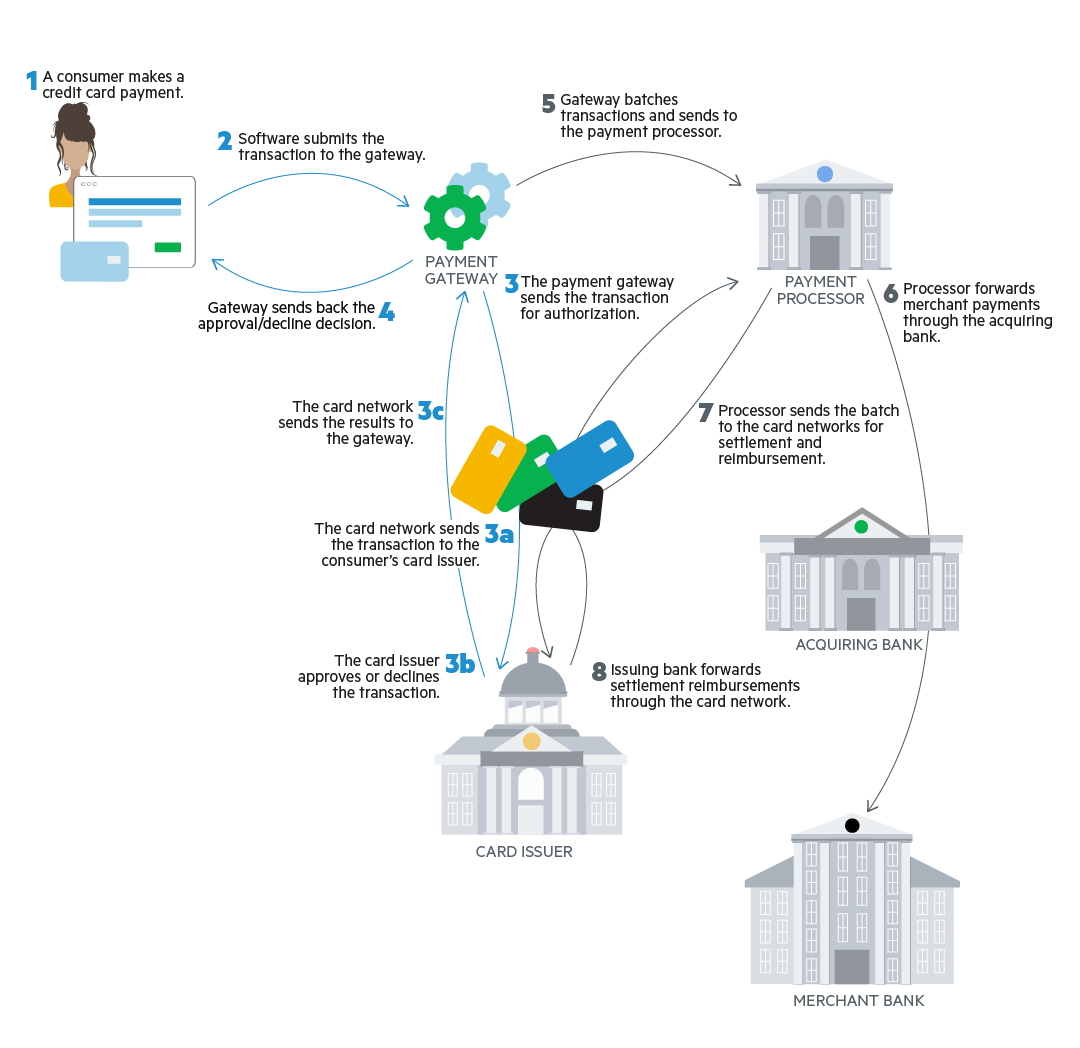

A credit card transaction starts when the consumer swipes, taps, dips, or uses a digital wallet, like Apple Pay, to make a purchase or pay a bill.

The merchant’s terminal or payment gateway sends the card and purchase information to the payment processor, who then sends it to the card issuer via the card network.

The issuing bank receives the payment request and verifies whether the card is valid and the cardholder has credit available to complete the purchase. During this process, card issuers can also verify the identity of the cardholder and check the transaction for any signs of fraudulent activity.

The card issuing bank either authorizes or declines the transaction and sends the response back to the merchant through the card network, acquiring bank, and the payment gateway or terminal.

Step 2: Settlement

Settlement completes the credit card transaction. During this process, funds for the purchase are reimbursed to the merchant and fees are paid to the parties who helped facilitate the transaction.

At least once each day, the payment processor totals the amounts from a batch of transactions and transfers the amount to the acquiring bank, minus a fee. The acquiring bank transfers funds to the merchant, minus their own fees.

The payment processor sends details for the batch of transactions to the appropriate card network, which in turn transfers it to the appropriate card issuing bank.

The card network collects money from the card issuer and reimburses the payment processor minus an interchange fee. Finally, the card issuer bills the cardholder for the transaction. Cardholders may pay fees or interest based on their credit card agreement.

The Costs and Fees of Credit Card Processing

In today’s increasingly electronic world, businesses need to accept credit card payments to maintain their customer service satisfaction and prevent lost sales. If you’ve followed so far, you’ve noticed there’s a complex infrastructure involved with processing credit cards, which affects the cost of processing credit cards.

The merchant discount rate is the fee merchants pay to their acquiring bank or payment processor for credit card transactions. It includes:

- Interchange Fees: Paid by the acquiring bank to the card issuer to cover the cost of handling credit cards and the risk of approving credit card transactions. Interchange is set by the card networks and is between 1.5% and 3.3%.

- Assessment Fees: Charged by card networks for using their network.

- Markup Fees: Charged by a payment processor to cover the cost of processing credit card payments.

Incidental Fees

Payment processors may charge fees when certain events happen.

- Chargeback Fees: Charged when a cardholder disputes a transaction with their issuing bank.

- Batch Processing Fees: Charged each time a business submits a batch of credit card transactions.

- Early Termination Fee: Charged if you cancel a payment processing contract before it expires.

In today’s highly digital world, businesses cannot risk losing revenue simply because they cannot accept and process card payments. Debit and credit card processing is no longer a great feature, but an essential requirement for modern businesses.